Types of tax

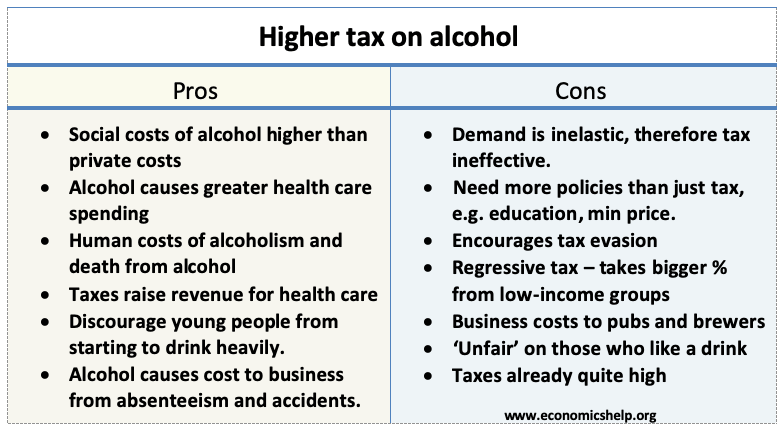

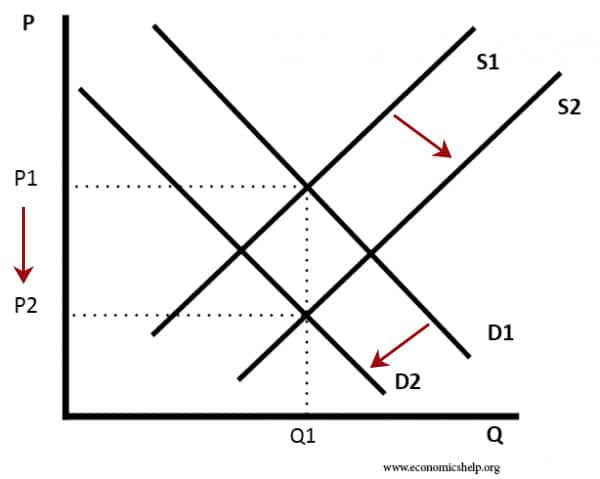

A tax is a charge levied by a government to raise revenue. The main types of taxes include Income tax – a percentage of income. Corporation tax – a percentage of a firm’s profit. Sales tax/VAT – an indirect tax on the sale of goods. Excise duties – taxes on alcohol, tobacco, petrol. Production taxes …